Preliminary Title Report

Are you in the process of buying a home in California? One important document you’ll encounter is the preliminary title report. The report is extremely essential to understand all the legal aspect relating to the property and any problems that may arise in the future.

What is a Preliminary Title Report?

What is a preliminary title report? A preliminary title report is a document prepared by a title company that discloses the current legal ownership of a property and any claims, liens, easements, or other encumbrances that may affect the title.

It is slightly different from what is known as title insurance but it is tendering to issue the title insurance provided certain facts which are listed are exceptions. The preliminary title report affords the buyers a chance to examine any problems to do with the title before making a final settlement on the property.

There isn’t any guarantee or representation of title condition in what is referred to as preliminary title report. It simply reports the current vested owner, legal description, and matters that the title company would exclude from coverage if a title preliminary report policy were to be issued at that time.

The preliminary title report is inform of a title preliminary report with details that are important to be looked by the buyers and the lenders before the buying process takes place.

How to Get a Preliminary Title Report in California

How do you obtain a preliminary title report in most California real estate transactions? The seller normally instruct a title company to commence the preliminary title report as soon as the escrow is opened.

The title company then conducts a search by taking a title search in the public records to determine the vested owner and matters relating to title. The resulting preliminary title report california is provided to the buyer as part of the seller’s disclosure packet.

While it’s customary for the seller to pay for the buyer’s title preliminary report policy in preliminary title report california, the buyer is responsible for covering preliminary title report cost. These customs may differ depending on a region, that is why it is advisable to ask your real estate agent, who is the party that will be charged with the fees for the preliminary title report or title insurance policies in your transaction?

To obtain free preliminary title report, you’ll need to engage a licensed preliminary title report california title company or agency. Another way is to find them on the Internet or turn to your real estate agent, lender or attorney for some recommendations.

After choosing the title company of your choice, you have to deliver an order for title preliminary report together with the information concerning the property and the transaction. It is then the turn of the title company to start searching and examining for the title.

Reviewing Your Preliminary Title Report

Where can i get a preliminary title report? A preliminary title report should be taken as an excellent indicator of the property’s history of ownership and it is advisable to consult your real estate agent and attorney before signing the title paperwork.

When selecting a property to invest in, you’ll need to consider whether there are problems that can be easily found that will affect your ability to use the property and enjoy it as you please. Here are some key items to examine:Here are some key items to examine:

Vesting and Ownership

The name of the current owner should be filled correctly and correspond to the name of the seller indicated in the purchase contract. A preliminary title report is will also describe the nature of the ownership interest for example fee simple; leasehold; life etc fee simple is however the best and most comprehensive form of interest.

Liens and Encumbrances

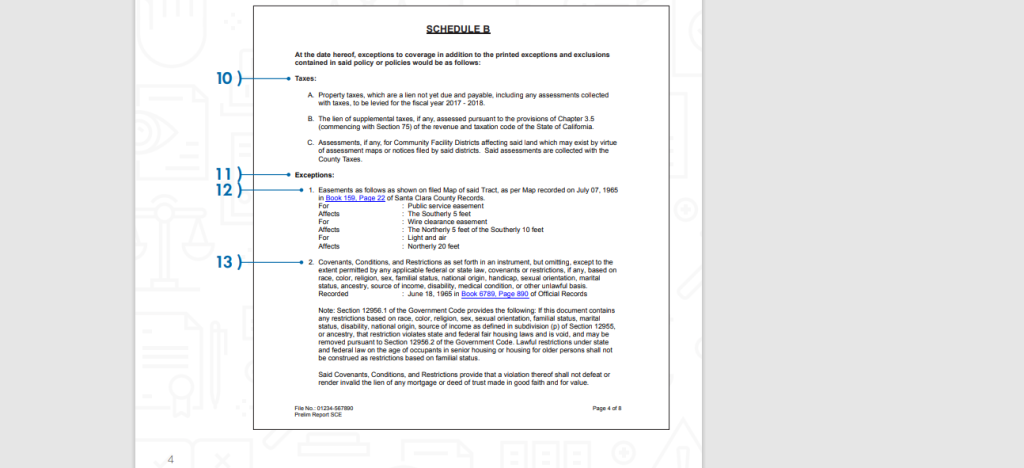

Check if there exists any encumbrance in the land such as a mortgage, tax lien, judgment or a mechanic’s lien. Of any contingent or outstanding liens, it is important to note that it can only be discharged at closing time. A preliminary title report quizlet should provide details on the type of lien, document number, and contact information for the lien holder.

Easements and Use Restrictions

Determine whether there are any recorded easements that allow other people, utilities, for example, use a portion of the land of the property. The preliminary title report definition will also disclose any Covenants, Conditions and Restrictions (CC&Rs) that limit how the property can be used or altered. Make sure you understand these restrictions and whether they conflict with your intended use of the property.

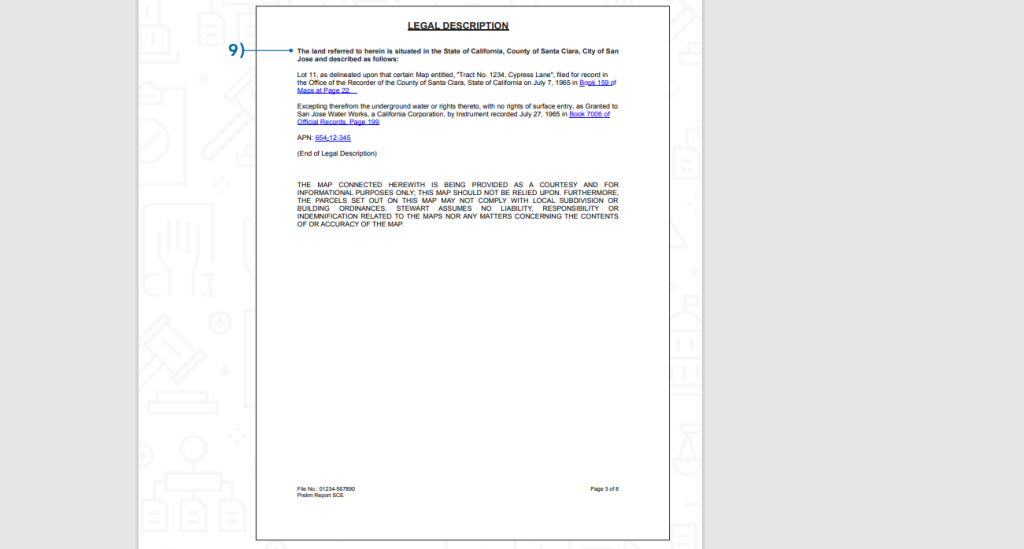

Legal Description

Verify that the legal description of the property matches what you intend to purchase. The preliminary title report will include the lot and block number, tract map number, or metes and bounds description. You may need a surveyor to plot the exact boundaries.

When you see anything that wrongs or if you have any question, do not hesitate to consult your real estate agent and title officer. There could be some language slips that you might be able to have removed or may be negotiate the issue to the ‘seller’ to be dealt at the finality stage. If there are problems with the title the law states that you can choose to cancel the transaction and get your money back.

Preliminary Title Report vs Title Report

What’s the difference between preliminary title report and title commitment? While they may sound similar, a preliminary title report vs title report serve different purposes:

A preliminary title report is issued prior to closing and describes the current condition of title, including any defects, liens or encumbrances. It acts as a “snapshot” of title but does not itself provide any insurance coverage.

The other one, title report, refers to the insurance policy that is given to you at the time of closing. This policy guarantees ownership title and provides coverage to eradicate all the title defects and encumbrances as stated under this policy.

So in short, the preliminary title report vs title report real estate is that the prelim report is the initial offer and disclosure of title conditions, while the final title report is the actual insurance contract that provides coverage to the new owner and lender. Some of the items in the preliminary title report which are listed as exceptions may be cleared or eliminated in the process of closing so that they do not feature within the policy.

How Much is a Preliminary Title Report in California?

Preliminary title report cost is usually bundled into the overall title insurance premiums and fees. In California, title insurance rates are regulated by the Department of Insurance, which sets the maximum allowable fees based on the purchase price.

Service fees of a preliminary title report in California depend on factors such as the value of the property, a comprehensive report of title and other additional work to be conducted. In most of the circumstances, individuals are likely to spend between $75 and $250 in order to acquire the basic report. For additional detailed or more complicated reports when client owns property with high value the cost may go up to and beyond four hundred dollars and up to a thousand dollars.

These are general and approximate costs, and actual cost of the preliminary title report may vary depending on the particularities of the transaction and the title company’s rates. As a rule, the price for the owner’s policy is included into the price offered by the seller whereas the cost of the policy protecting the lender’s interests is to be covered by the buyer.

It’s a good idea to compare quotes from multiple title companies to get a sense of preliminary title report cost. However, the mistake that most organizations make is focusing on the provider that offers the lowest charges without regard to the quality of the service they are going to receive or how that provider underwrites risks. When selecting a title company, seek a seasoned one which is responsive and willing to deal with any problems that may come up.

How Long Does a Preliminary Title Report Take in California?

Well then how many days does it take to conduct a title search in California for a preliminary title commitment? The answer possibly depends on certain factors some of which are the degree of the title, existing documents available for public use, and number of title companies that the person intends to handle at a given time.

On balance therefore, most preliminary title reports can be produced in within 3 – 7 days after the order has been placed. Nevertheless, if there are some issues and flaws leading to extra investigate work and approval necessary, it may take much time.

How fast can you get a title in California? If you need the preliminary title report expedited, you can usually request rush service for an additional fee. Some of the title companies provide the preliminary title reports within 24-48hours or otherwise, this may attract some fees.

To make the process quicker, try offering the title company the asked for papers which include the purchase agreement, the receipt for the deposit, or an identity statement collectively known as the title affidavit. The more complete the file the better position they are in to prepare the preliminary title report so the sooner they have it the better.

How to Get a Preliminary Title Report for Your California Home

If you’re ready to order a preliminary title report for your California home purchase, here are the steps to follow:If you’re ready to order a preliminary title report for your California home purchase, here are the steps to follow:

- Open the escrow, with the title company. Your real estate agent and/or lender can provide you with some recommendations of the reliable providers in your area. They have to enter into a contract and they have to pay the preliminary non-refundable deposit.

- Win the title company’s package much the signed purchase contract and any other details of the transaction for instance the property address, the agreed price for the property, and the closing date.

- Now the title company will proceed to search the records and other databases to establish the line of title as well as other existing liens, encumbrances or defects. This process normally takes a few days to one week depending on the equipment’s being used.

- After the search is done, the title company creates the first title search report and forwards original copies to the buyer, the seller and the financier.

- Carefully review the preliminary title report with your real estate agent and attorney. If there are any red flags or issues, raise them with the title company and seller right away. You may be able to get certain exceptions removed or negotiate repairs/credits.

- If all looks good, proceed with closing and the title company will issue the final title insurance policy insuring your ownership rights in the property.

Preliminary Title Report California

When buying property in preliminary title report california, it’s crucial to obtain and review a preliminary title report early in the transaction. There are some peculiarities characteristic only to California when it comes to title insurance and closing costs.

It is a norm in most of the preliminary title report california where the seller is responsible for the buyer’s owner’s title insurance policy whereas the buyer is responsible for the lender’s title policy. However, such practices may slightly differ from county to county, or state to state, hence, contact your agent for more information.

Preliminary title report california also has specific disclosure requirements for sellers. Sellers must provide buyers with a Transfer Disclosure Statement (TDS) and Natural Hazard Disclosure (NHD) report along with the preliminary title report. These disclosures reveal any known defects, environmental hazards, or other material facts about the property.

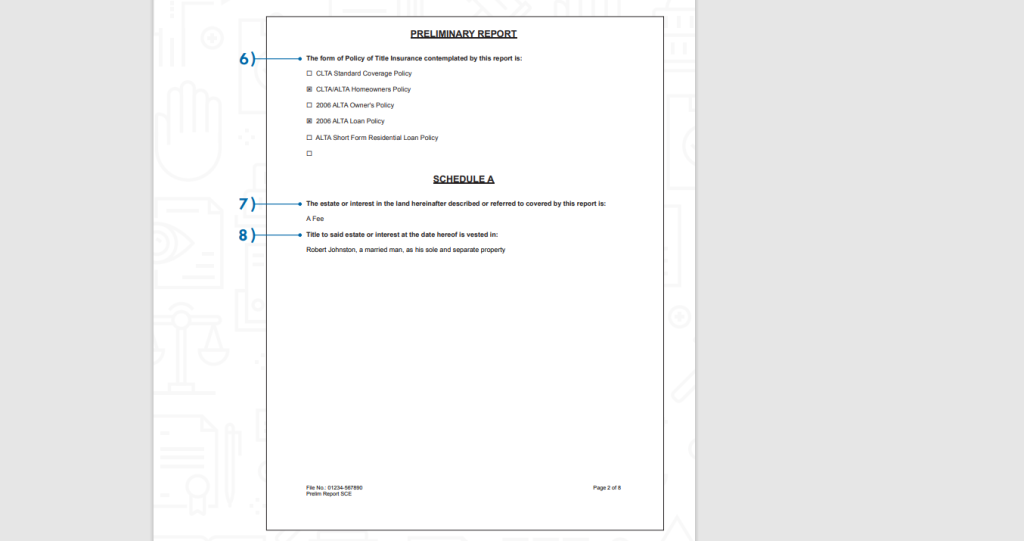

Preliminary Title Report Example

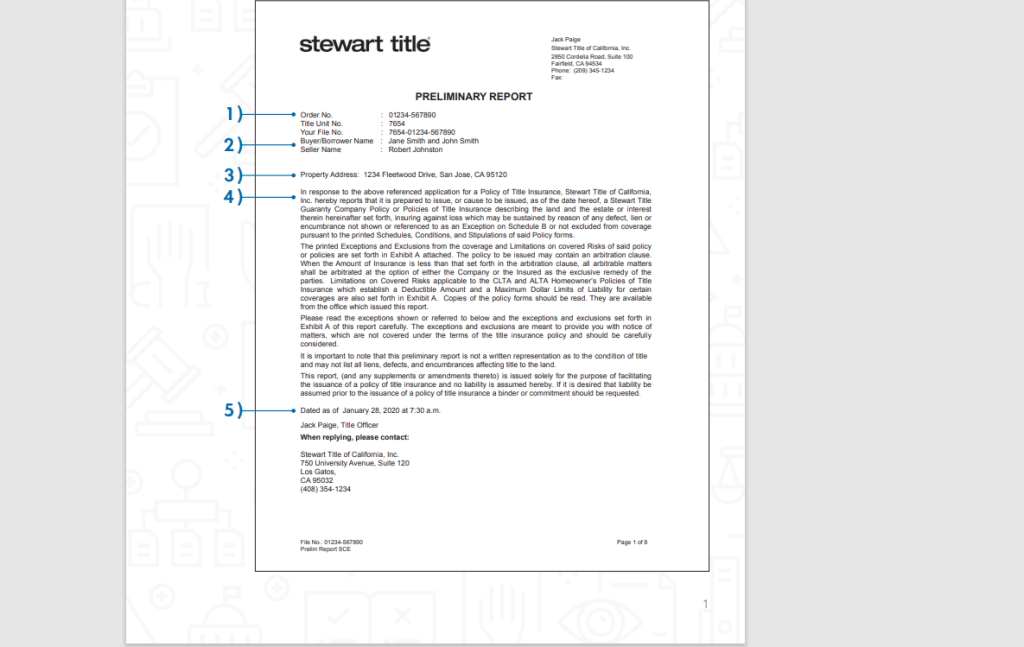

To better understand what a preliminary title report looks like, let’s examine a preliminary title report sample. While the exact format and content may vary by title company, most preliminary title report example will include the following key sections:

- Effective Date: The date and time on which title search was done till.

- Policies/Endorsements: The nature of the title policies and endorsements to be issued, the proposed insured and the amounts of coverage.

- Exceptions: An open list of title specific exceptions which are to be excluded by the insurance policy including but not limited to liens, easements, CC&Rs etc.

- Requirements: Anything which has to be completed for the title company to issue its policy, like paying out a mortgage, furnishing a deed, etc.

- Legal Description: The method of physically identifying legal references used to subdivide the property such as metes and bounds or lot/block number.

- Plat Map: A document that will illustrate the existing dimensions and outlines of tracts, road right of way and recorded encouragedment or encroachment.

- Tax Information: Information that pertains to the current property taxes such as the type, number of the parcel, its current assessed value, whether it has any exemptions or whether it is in arrears.

It is often possible to browse online preliminary title report sample or get one from the title company that would help to understand the format and some of the terms used. It is very helpful to examine a sample of title commitment, and this guides one on what to check for later on.

Preliminary Title Report Definition

Let’s recap preliminary title report definition – what exactly is this important document? In layman terms, the preliminary title report definition can simply be described as a document produced by title company, showing more of the present state of ownership on the subject real property, existing flaws in title or the defects, liens or encumbrances that impact on clear title.

It’s important to understand that the preliminary title report definition is not the same as title insurance. Rather, it is an offer to issue title insurance subject to the stated exceptions and requirements being met. The preliminary title report itself does not provide any coverage or guarantee of title.

When reviewing the preliminary title report definition, look for information on:

- The current vested owner(s)

- The type of ownership interest (fee simple, leasehold, etc.)

- Recorded liens, such as mortgages, taxes, judgments, or HOA dues

- Easements, CC&Rs, or other restrictions on use

- Any pending legal actions or bankruptcy filings

- Requirements to close, such as paying off liens or providing documents

Preliminary Title Report Online

Most title companies today take advantage of digital real estate transaction and hence allow a client to order and review their preliminary title report. Instead of waiting for physical copies to be mailed, you can usually access the preliminary title report online through a secure portal or email.

To obtain preliminary title report online, first identify a good title company that provides for online services. They are usually free of charge and usually they will just require one to sign up and input some of the details of the property as well as the transaction. The title company will then perform their search and upload the preliminary title report online for you to review at your convenience.

Some benefits of accessing preliminary title report online include:Some benefits of accessing preliminary title report online include:

- Faster delivery times

- 24/7 access to documents

- Friendly with your agent, attorney or lender, where (whereas) sharing is not a hassle.

- Less paper use and different papers lying around.

- Confidentiality and proper storage of the incriminating data

Of course, if you want the actual copy, you can still request a preliminary title report to be delivered or be picked at the office. However, preliminary title report online seems to be a more convenient method to many smart buyers and sellers in the technological age.

Preliminary Title Report vs Commitment

One common question is what’s the difference between preliminary title report and commitment? While these terms are often used interchangeably, there is a slight distinction:

A preliminary title report is an initial disclosure of the current status of title, including any defects or exceptions that would be excluded from coverage if a policy were to be issued at that time. It is not a binding contract.

A title commitment, on the other hand is an undertaking between the title company and the policyholder as to the issuance of a particular policy of title insurance depending on the fulfillment of some conditions. It is one step further than the preliminary report as for the obligation of the company.

Actually, in most of the title companies, the first report that is given is called the preliminary title report which entails both the disclosure and the commitment to insure. The major distinction is that a preliminary report is yardstick more informative, while the commitment implies that the company must proceed and actually release the policy provided all the terms and conditions are met.

When comparing preliminary title report vs commitment, it’s important to understand that both provide valuable information for buyers and lenders. But if you want a more binding assurance of coverage, be sure to get an actual commitment rather than just a preliminary report.

The preliminary title report is a crucial document in the California real estate buying process. It contains useful information about the condition of title and any weaknesses or problems that exist that have to be resolved. By understanding what is preliminary title report, how to obtain it, what to look for, and how it differs from the title report real estate, you can make informed decisions and protect your investment.

A preliminary title report is one of the few prerequisites that are usually reviewed in the process of the transaction On this Note, regardless of whether one is a first time buyer or an experienced investor, taking time in going through the preliminary title report is crucial to enhancing the possibility of a successful transaction.

Consult with your real estate agent and your selected title company to manage the process and solve all the encountered problems. Still and all, it is something about the notion of knowing; with that knowledge and that guidance, you’ll be able to open the door to that great, great California home of yours with a sense of certainty.